While we continue to face the morphing challenges of living with COVID and the evolving digital frontier, it’s time to set yourself up with the lingo you’ll need in 2022 so you can talk with confidence in any digital discussion.

In this blog, we explore –

- Fintech buzzwords – what you need to know in 2022

- What’s the deal with the Metaverse?

Fintech buzzwords

With more than 8,000 cryptocurrencies in existence and NFTs on the rise, more and more individuals and businesses are looking into or actively investing in the digital currency over traditional stocks. To keep you abreast of the common terminology, here’s the 411.

Cryptocurrencies

Think of cryptocurrency as the next gen of currency. They are decentralised digital assets that investors can buy, sell and exchange directly with other people, without an intermediary like a bank. The crypto market is constantly moving, a 24/7 cycle.

You know the trend is coming to a peak when the Big Banks want to get involved. Commbank are currently piloting a portal to buy, sell and exchange cryptocurrency.

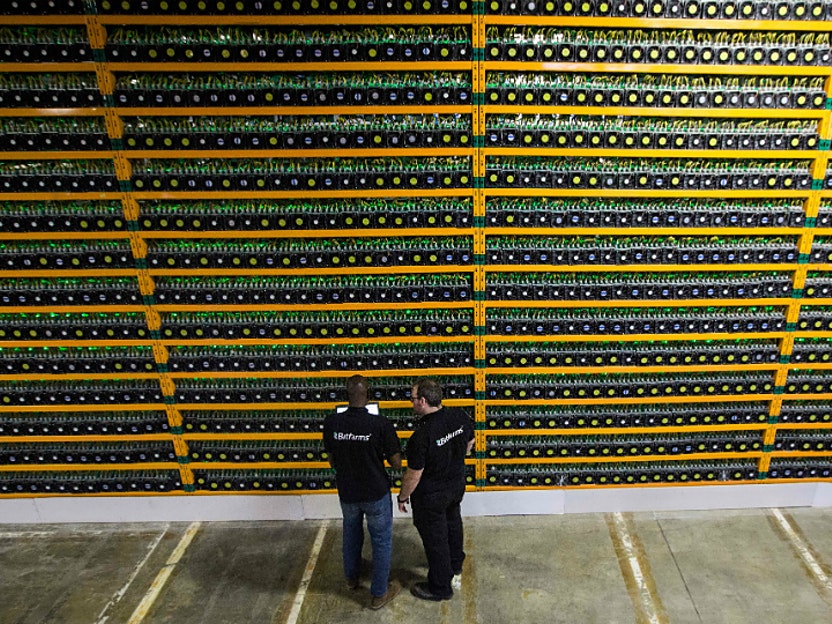

Mining

Crypto coins are created through a “mining” process, whereby millions of computers track and verify the existence of every single coin. A coin’s ownership history is stored in a blockchain, which increases the transparency and legitimacy of the asset.

Mining requires massive amounts of computing power, resulting in an incredible amount of electricity being required to undertake the process. It is estimated that global Bitcoin mining efforts consume 200 terrawatt hours (TWh) of electricity each year. For context, Australians consumed 192 TWh of electricity in 2020. As a result, renewables are increasingly being used to power cryptocurrency mining activities.

Blockchain

At its simplest, blockchain is a list of all transactions that have ever occurred on a digital asset. Think of this as transaction history, like your bank statement, but for an asset.

Data stored in a blockchain is grouped into blocks (hence the name) rather than tables used for traditional databases. Once a block is full, it is linked to the previous block and the data cannot be altered.

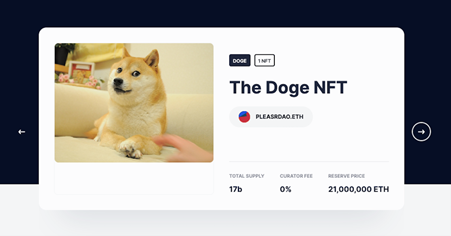

NFT (non-fungible-token)

If crypto is the next gen of currency, non-fungible tokens (NFTs) are the next gen of collectibles.

NFTs are digital files that can be attached to a blockchain. Only the owner of an NFT has the right to sell the digital asset. They’re in their infancy, use cases stemming mainly back to artists and digital content creators. Meme’s have sold for thousands of dollars.

Web 3.0

And lastly Web 3.0 – which is still in its infancy with no universally agreed definition. This next phase of the internet is expected to be towards a decentralised web in response to the fact that the major share of the web belongs to big tech corporations. It includes topics such as NFTs, Decentralised Finance (DeFi) ie “public blockchains” and Decentalised Autonomous Organisations (DAOs)… just to add a few more acronyms to your kit bag.

Welcome to the Metaverse

Late last year Mark Zuckerberg from Facebook announced the business’s change in name to Meta. With aspirations to grow the Facebook brand beyond Social Media, a bigger entity has been formed to tackle the Metaverse.

The Metaverse is the extension of the internet in 3D virtual reality spaces, where users can interact, socialise, explore and create content in the virtual environment, and monetise their virtual transactions using blockchain technology and cryptocurrency.

Big brands are already onboard, creating virtual storefronts to sell physical products, and intangible NFTs like Nike, or to test out influencer marketing in the digital realm, like Prada.

Thanks for reading our first edition for 2022 and we look forward to speaking with you soon.

Stay well.